Highland Park’s $130 million budget, includes 1% grocery tax and 8% levy bump

The Highland Park City Council gave its nod on Nov. 24 to a $130 million 2026 budget that includes a 1% grocery tax starting Jan. 1 and costlier parking citations.

The council also prepared to pass an 8% increase in the 2025 tax levy and a 10% increase for the public library’s levy after a public hearing was held the same night. The 2025 tax levy is billed and collected in 2026.

For an owner of a property with a $500,000 equalized assessed value, the increase is expected to be about $138 in additional annual property taxes, said Kristi McCaulou, the city’s finance director, at the Nov. 24 City Council meeting.

Mayor Nancy Rotering said the city’s 2026 budget is balanced, fuels the tax levy and includes more revenues than expenses. It includes 274 full-time employees, up about one position from 2024, and a $40 million capital improvement plan she described as an investment in the city’s infrastructure and its future health and welfare.

“This budget meets this moment. It plans for the future, and it comprehensively supports our mission,” of providing municipal services effectively and efficiently, Rotering said.

“With a lot of external volatility, this is a thoughtful budget reflective of our values and promises to the people of Highland Park,” she said.

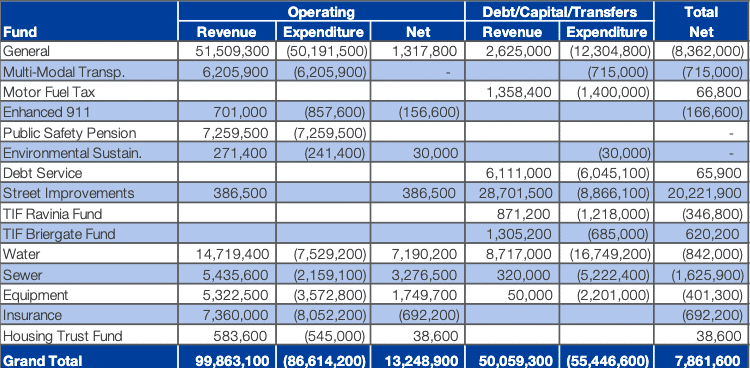

The operating budget shows a $13.29 million surplus, led by more than $10 million from the Sewer and Water funds. The city is planning close to $18 million in water-system and sewer improvements in 2026, including lead service-line replacements.

The levy

At a public hearing held during the council meeting, Finance Director Kristi McCaulou presented the proposed tax levy of $19.75 million for the city, up 7.9% from the previous year, and $6.4 million for the library, up 9.5%. A debt service levy of $5.4 million represents an 84% increase from 2024, according to information presented to the council.

“The increase is heavily driven by debt service levy … that has to do with payments of previously issued debt,” Mcaulou said.

McCaulou also said the city portion of a Highland Park property owner’s tax bill represents about 8% of the total amount, while the library portion is about 2.5%. About 72% of the tax bill goes to the public schools, while the park district receives about 7%, according to McCaulou.

Pension obligations of $7.9 million command about 30% of the city’s levy, while capital for roads represents about $3.8 million, according to information presented.

Fee changes

While most city fees are staying the same in 2026, the budget includes several significant increases over 2025. They include:

•Parking-violation fee from $25 to $50 for Ravinia north, east and west parking lots from June 1 to Sept. 15

• Outdoor dining street parking from $150 to $300 (approved in August)

• Business registration fee from $40 to $70

• Nonprofit registration fee from $0 to $25

• Storage container permit from $0 to $75

• Demolition for single-, multi-family homes from $10,000 to $15,000

• Late fee for liquor-license renewals from $350 to $700

Additionally, EMS assisted-living impact fees will increase at varying amounts depending on the number of requests as a percentage of the facility’s total number of beds, up to a maximum of $20,000 when the percentage hits 200% or more.

Offsetting the 1% local grocery tax, which the council passed in June in response to the state’s elimination of its grocery tax, are several discounted fees in the city’s “low income program.”

To help reduce the burden of fees for essential home maintenance and repairs, such as for plumbing and roof work, the city will provide a 50% discount on water service connection fees and building permit fees, such as for fences, electrical work, plumbing and roofing. It also will provide lower sanitary or storm sewer connection fees for low-income residents.

Water rates for most city residents are set to increase 15 cents per per 100 cubic feet, bringing the rate to $4.27 per 100 cubic feet for up to 6,000 cubic feet. After 6,000 cubic feet, the rates rise as high as $4.91 for over 8,000 cubic feet. Commercial customers are scheduled to pay $4.69 per cubic foot in 2026 from $4.53 in 2025.

The new budget includes higher sewer rates of $6.80 for residential customers and $10.15 for commercial customers, billed quarterly, the city said. Low-income residents pay 90 cents per month. The stormwater utility fee is set to increase to $9.50 per month for most residents.

The budget also includes new electric-vehicle charging fees of 25 cents per kilowatt hour and a loitering fee of $1 per minute after the posted time limit has expired by 15 minutes.

The Record is a nonprofit, nonpartisan community newsroom that relies on reader support to fuel its independent local journalism.

Become a member of The Record to fund responsible news coverage for your community.

Already a member? You can make a tax-deductible donation at any time.