With deficit looming, Skokie trustees will soon vote on first tax levy hike in 35 years

An unusual change is likely coming to Skokie’s property tax bills, one residents have not seen in decades.

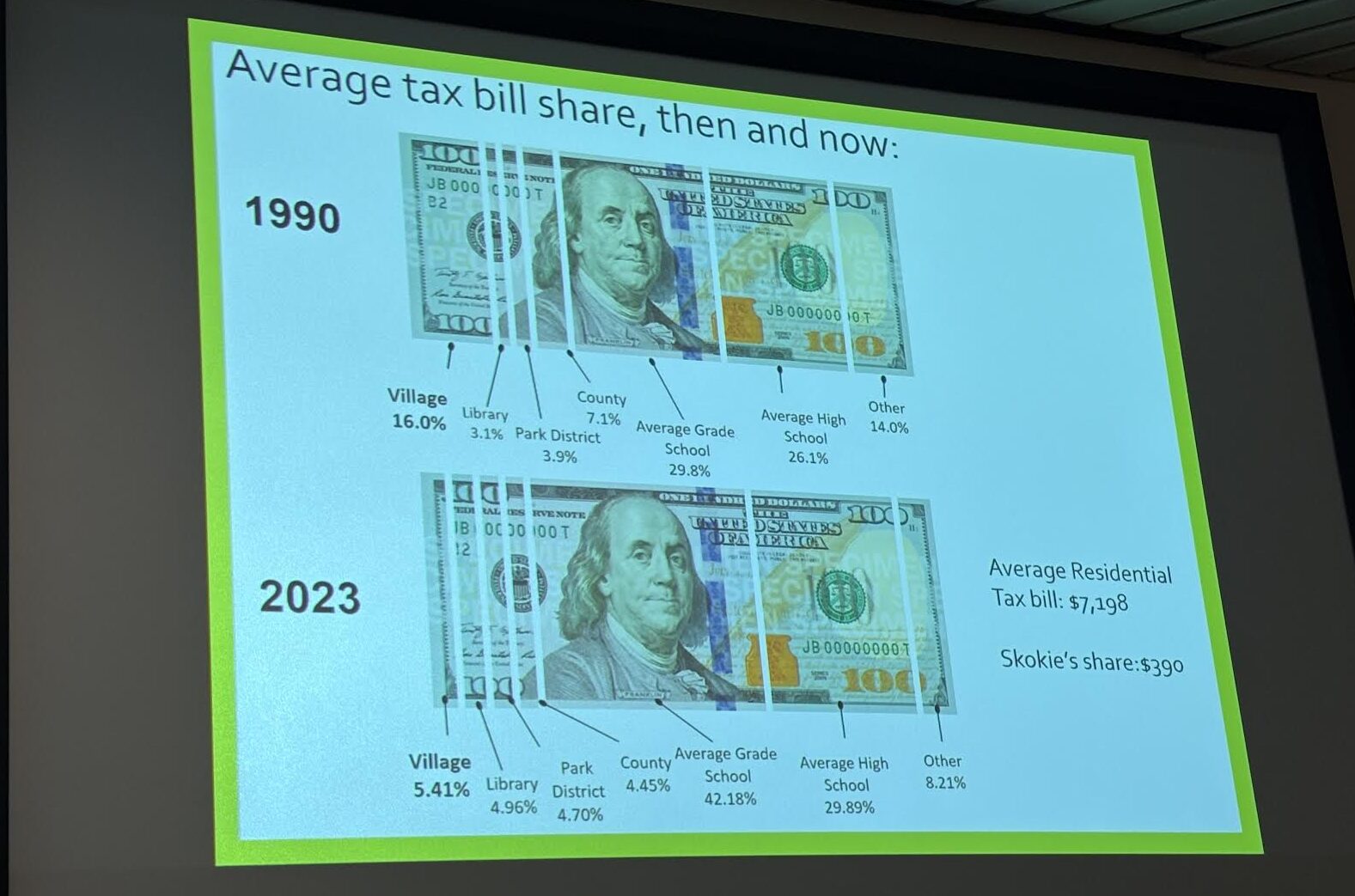

In a recent presentation to the Village Board, staff requested trustees vote on Monday, Dec. 1, to raise Skokie’s property tax levy for the first time since 1990 in an effort to help fund staff positions and meet the increasing cost of providing municipal services.

If the 4.85% increase is approved, officials project the average Skokie residence will cost an additional $21.34 in annual property taxes, commercial properties an additional $57.56 and industrial properties an additional $137.35.

The hike would go into effect next year, likely hitting bills in March and August 2026, and provide Skokie an estimated $749,649 in additional revenue, giving the village an estimated $16.21 million in property tax revenue toward its 2027 budget.

The existing amount of revenue Skokie accrues from its property tax levy — $15.46 million — has remained unchanged since 1990. The Village Board voted in 1991 to freeze its property tax levy at that 1990 level, and trustees have voted to keep that freeze intact ever since.

That doesn’t mean, though, that taxes haven’t risen in that time.

Property values have continued to increase in that time. As Julian Prendi, the village’s finance director, told the trustees on Nov. 17, the value of all taxable property in Skokie has risen from $1.1 billion in 1990 to $3.2 billion in 2023, a 204% increase.

On the expense side of the Village’s ledger, inflation has caused the cost of providing municipal services — from Skokie’s waste removal to its police force to its “free” leaf pick up — to increase by 109% since 1990, Prendi said.

To keep the 1990 level of its tax levy intact, Skokie has implemented “consistent cost containment efforts,” like amending contracts, postponing noncritical capital projects and instituting a 2010 hiring freeze that still “impacts” 39 staff positions, village documents show.

Officials say those measures are now not enough, and without new sources of revenue, Skokie’s expenditures will exceed its revenue by 2028 and its reserves will be entirely depleted by 2033.

Skokie will also lose funding from a federal grant in 2027 that supports three firefighter positions, and the hiring freeze is reportedly “beginning to impact service levels,” so village staff have requested funds to hire three new positions in yet unspecified departments.

“Raising taxes is deeply unpopular but also, in this case, extremely necessary and I just want to be on record that this is going to be a very difficult and unpopular decision, but we clearly, clearly need to do it,” Trustee Lissa Levy said during the Nov. 17 Village Board meeting.

“We are relying on staff to do so much with so little and I think that we need to be really cognizant of how dedicated we’ve been under such constraints and that we as a community, if we expect services, need to be able to pay for those services,” Levy added.

Notably, officials say, property owners would have paid an additional $260 million in property taxes over the past 35 years if the village had increased its levy to keep up with the cost of inflation. That means the average Skokie homeowner would be paying an additional $469 a year.

The presentation on Nov. 17 showed that some area municipalities with similar populations to Skokie had a higher property-tax base in 2024, including Evanston ($48.6 million), Des Plaines ($32.2 million), Palatine ($22.7 million) and Arlington Heights ($39.7 million).

On the other hand, smaller but wealthier local communities, were collecting similar property tax revenue in 2024 — Glencoe collected $16.1 million, Morton Grove $13.1 million, Wilmette $21.8 million and Winnetka $16.2 million.

While village staff are requesting the board approve the tax increase, Prendi said their prevailing “philosophy” has been to push the burden of its revenue on visitors. To that end, Skokie’s largest single source of revenue is its sales tax, which accounts for 23% of its annual take.

About a quarter of that sales tax revenue comes from Old Orchard, and cell phone data indicates that up to 90% of shoppers at the mall last year came from outside Skokie zip codes, Prendi said, giving the village about $8 million in annual funding from visiting shoppers.

Skokie also taxes food and beverage purchases and gains revenue from building permits, but relying on those avenues leaves the village in “very high exposure” in the event of an economic downturn, Prendi said.

He added that 92% of tax-levy funding goes toward the village’s debt service and pensions.

The Village Board indicated during the Nov. 17 meeting they were in support of the property tax levy increase. Trustee Gail Schechter noted that property tax fees are a more equitable way of generating revenue as the burden will be blanketed across Skokie’s 26,000 properties.

While Prendi outlined the need for Skokie to boost its revenue, he also noted it was a triumph for the village to last 35 years without ever changing its property tax hike.

“That in and of itself is a feat worthy of celebration,” Prendi said of the tax levy being frozen since 1990.

“I am not aware of any community, certainly in the Chicago region but perhaps even in the state, that has been able to sustain a property tax freeze in amount, not rate, in amount, for that long of period of time.”

The Record is a nonprofit, nonpartisan community newsroom that relies on reader support to fuel its independent local journalism.

Become a member of The Record to fund responsible news coverage for your community.

Already a member? You can make a tax-deductible donation at any time.

Samuel Lisec

Samuel Lisec is a Chicago native and Knox College alumnus with years of experience reporting on community and criminal justice issues in Illinois. Passionate about in-depth local journalism that serves its readers, he has been recognized for his investigative work by the state press association.